The average one-year price target for Wave Life Sciences (NasdaqGM:WVE) has been revised to $32.70 / share. This is an increase of 60.82% from the prior estimate of $20.34 dated December 3, 2025.

The price target is an average of many targets provided by analysts. The latest targets range from a low of $21.21 to a high of $52.50 / share. The average price target represents an increase of 104.65% from the latest reported closing price of $15.98 / share.

What is the Fund Sentiment?

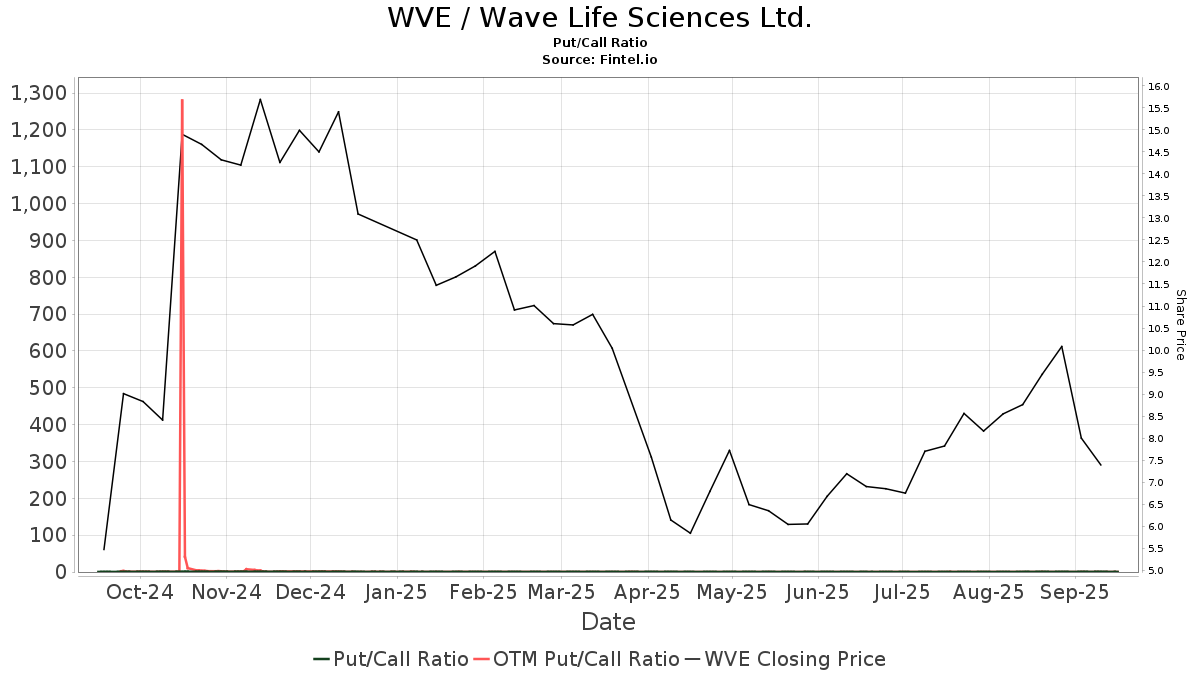

There are 372 funds or institutions reporting positions in Wave Life Sciences. This is an decrease of 5 owner(s) or 1.33% in the last quarter. Average portfolio weight of all funds dedicated to WVE is 0.27%, an increase of 3.84%. Total shares owned by institutions increased in the last three months by 2.71% to 161,205K shares.  The put/call ratio of WVE is 0.81, indicating a bullish outlook.

The put/call ratio of WVE is 0.81, indicating a bullish outlook.

What are Other Shareholders Doing?

Ra Capital Management holds 18,202K shares representing 9.95% ownership of the company. No change in the last quarter.

Adage Capital Partners Gp, L.l.c. holds 14,568K shares representing 7.96% ownership of the company. In its prior filing, the firm reported owning 15,016K shares , representing a decrease of 3.08%. The firm increased its portfolio allocation in WVE by 2.69% over the last quarter.

Maverick Capital holds 8,392K shares representing 4.59% ownership of the company. In its prior filing, the firm reported owning 8,262K shares , representing an increase of 1.55%. The firm increased its portfolio allocation in WVE by 1.82% over the last quarter.

Driehaus Capital Management holds 6,298K shares representing 3.44% ownership of the company. In its prior filing, the firm reported owning 6,532K shares , representing a decrease of 3.71%. The firm decreased its portfolio allocation in WVE by 2.79% over the last quarter.

M28 Capital Management holds 5,665K shares representing 3.10% ownership of the company. No change in the last quarter.

Fintel is one of the most comprehensive investing research platforms available to individual investors, traders, financial advisors, and small hedge funds.

Our data covers the world, and includes fundamentals, analyst reports, ownership data and fund sentiment, options sentiment, insider trading, options flow, unusual options trades, and much more. Additionally, our exclusive stock picks are powered by advanced, backtested quantitative models for improved profits.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.