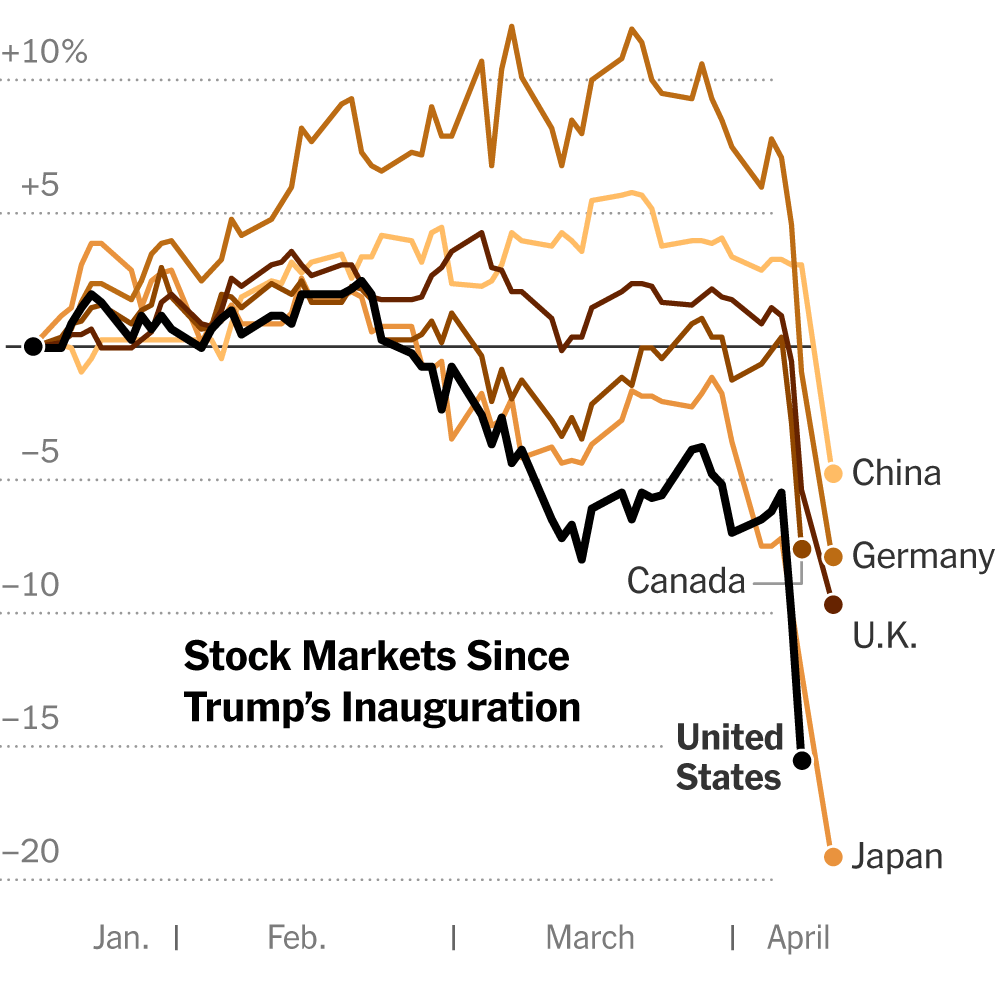

Financial markets around the world were slammed on Monday, as investors recoiled from the prospects of a severe economic downturn sparked by the escalating trade war.

The S&P 500 fell about 3 percent in early trading. The U.S. benchmark index could enter bear market territory — a drop of 20 percent or more from a recent peak — if those losses persist through the day.

Fears about the global fallout from the trade war intensified as hopes faded that the Trump administration would soften the tariffs imposed on America’s major trade partners.

On Sunday evening, President Trump doubled down, saying that he would not ease his tariffs on other countries “unless they pay us a lot of money.” When asked by reporters on Air Force One about the market turmoil and fears of a recession, he said that “sometimes you have to take medicine to fix something.”

The Nasdaq Composite index, which is dominated by technology stocks, dropped 3 percent. Shares in Nvidia fell 6 percent and shares in Apple dropped more than 5 percent.

Stocks in Europe were also down across the board, with the benchmark pan-European index dropping more than 4 percent.

In Asia, trading was extremely volatile throughout the day. Among the markets hardest hit were Hong Kong, where stocks plunged 13 percent, and Taiwan, which tumbled 10 percent. Stocks in mainland China were down 7 percent.

“There’s no sign yet that markets are finding a bottom and beginning to stabilize,” analysts at Deutsche Bank wrote in a note.

On Friday, China struck back at the United States with a 34 percent tariff on a number of American exports, matching a 34 percent tariff that Mr. Trump imposed on Chinese goods last week. China’s levies are set to go into effect later this week, shortly after the Trump administration’s “reciprocal” tariffs on dozens of countries are imposed. On Saturday, a 10 percent “baseline” tariff came into effect on nearly all goods coming into the United States.

Over the weekend, analysts had circulated notes warning that Asia could be particularly vulnerable to a tit-for-tat exchange of retaliatory tariffs between China and the United States. Many countries in the region, including Japan and South Korea, count both nations as their top trading partners.

Benchmark indexes in South Korea tumbled about 5 percent, while Australia fell more than 4 percent. In Japan, declines were so sharp that the country’s exchange operator briefly halted trading in Japanese stock futures on Monday morning. The country’s Nikkei 225 index closed down more than 7 percent.

Technology stocks across Asia were clobbered. Taiwan Semiconductor Manufacturing Company, the world’s largest chip manufacturer, fell nearly 10 percent, while Apple’s main contract manufacturer, Foxconn, also plunged 10 percent. In Hong Kong, the Chinese technology giants Alibaba, Tencent and Xiaomi all plummeted by double-digit percentages.

Japan’s Nintendo, which cited tariffs when it delayed pre-orders for the sequel to its best-selling Switch video game console, declined more than 7 percent.

In Europe, no industry escaped the sell-off, those some of the losses eased in afternoon trading. Banks were hit as fears of a general economic slowdown and freeze in deal-making took hold. Shares in Germany’s Deutsche Bank and Britain’s Barclays both dropped more than 4 percent.

Shares in defense companies also fell, no longer finding support from recent promises by European governments to ramp up military spending. Shares in Germany’s Rheinmetall and Italy’s Leonardo both declined about 3 percent.

Government bonds fluctuated on Monday morning. Germany’s 10-year bond yields were at 2.56 percent, having earlier traded as low as 2.43 percent. U.S. 10-year Treasury yields climbed back above 4 percent.

In oil markets, prices fell about 2 percent, adding to steep losses last week.

The 10.5 percent drop in the S&P 500 on Thursday and Friday was the worst two-day decline for the index since the onset of the coronavirus pandemic in 2020. On Friday, the S&P 500 closed 17.4 percent below its peak from February.

The only other instances of a worse two-day drop came during the 2008 financial crisis and the 1987 stock market crash, according Howard Silverblatt, senior index analyst at S&P Dow Jones Indices. In dollar terms, the more than $5 trillion that was wiped out in the S&P’s value in the two days last week stands unmatched.

Even more unusual is that last week’s sell-off stemmed directly from presidential policy.

The historically high tariffs that Mr. Trump announced on Wednesday caught investors, economists and businesspeople off guard, upending economic forecasts.

Chief executives have begun warning consumers that they should expect prices to increase on some groceries, clothes and other products. Consumers have said they intend to rein in spending on big-ticket items. Some auto companies have already announced production pauses overseas, as well as job losses domestically. Bank economists have raised the odds that a recession will hit the United States over the next 12 months. As countries responded last week with tariffs of their own, the sell-off in financial markets accelerated.

The hedge fund manager Bill Ackman said on the social media platform X on Sunday that he supported Mr. Trump’s attempt to fix global tariffs, but implored the president to call a “90-day time out” on Monday.

Otherwise, “we are heading for a self-induced, economic nuclear winter, and we should start hunkering down,” he said. “May cooler heads prevail.”

Keir Starmer, the British prime minister, warned on Saturday that “the world as we knew it has gone” and urged countries not to retaliate against the United States and enter a full-blown trade war.

The Nasdaq Composite index, which is chock-full of tech stocks that came under pressure as the sell-off accelerated last week, is already in a bear market, down almost 23 percent from its December peak. The Russell 2000 index of smaller companies that are more sensitive to the outlook for the economy has fallen over 25 percent from its November peak.

Tesla’s shares fell 10 percent on Monday after Dan Ives, an analyst at Wedbush Securities who had long championed Elon Musk’s car company, slashed his target for its stock price.

Scott Bessent, the Treasury secretary, said on Sunday on the NBC program “Meet The Press” that he saw “no reason” to expect a recession.

But analysts warned that the damage to the economy will depend on how long tariffs remain at elevated levels.

“We remain very cautious,” said Stuart Kaiser, an equity analyst at Citi. Even with last week’s drop, he said, markets may have further to fall because earnings and economic growth expectations remain “well above levels consistent with announced tariff levels.”

Tony Romm contributed reporting.